My Development as a Commodities Trader: TRADE UPDATE: COFFEE ROBUSTA 2008-09-23

2008-12-31

TRADE UPDATE: COFFEE ROBUSTA 2008-09-23

2008-12-16

UPDATE: When going gets tough .... the Dollar gets going

My Development as a Commodities Trader: When going gets tough .... the Dollar gets going

TRADE UPDATE: Is silver setting up to outpace Gold?

My Development as a Commodities Trader: Is silver setting up to outpace Gold?

2008-12-07

Is silver setting up to outpace Gold?

SILVER SIH9/ZIH9 GOLD GCJ9/ZGJ9 PAIR

SILVER SIH9/ZIH9 GOLD GCJ9/ZGJ9 PAIR

2008-12-06

TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: TRADE UPDATE: All that shines is not Gold

I am out of this trade again at 760 (+24 points) though I was hoping to ride is much longer. The range action is frustrating me in most markets and I thank all my guardian angles whenever I can come out profitably on any trade in these markets. I am by nature a trend following trader and therefore the range kills me many times.

The price action on S&P during Friday session rang some alarm bells for me and I was in no mood to leave positions over weekend. In addition Gold did touch my first anticipated breach level (743) but bounced off strongly.

If I see weakness next week I might go in again as I am still not a bull of Gold but for the time being, remaining out of this market seems like a reasonable position to be in.

Rice is Rising

ZRH9 (Rough Rice)

ZRH9 (Rough Rice)

Buy on break above 1426 stop below 1330 target 1559 - 1669

While reviewing grains chart it caught my eye that when all other grains (wheat/soy bean/corn/oats) are making new lows and plunging further, rice seems to be the one which has bounced off smartly and also resisting any down days in other grain complex. Rice has bounced off a long term support and therefore some upside could be possible. I am watching if Rice breaks above 1426 or if 1330 level is not breached before entering the trade.

Since fundamentals come in charts first I will also keep an eye on any fundamentals developing.

Point to note is that rice is bit illiquid on CME and therefore can easily be manipulated so it pays to be on the right side of the manipulators. For the same reason I would look to trade March 09 contract (ZRH9) and not the front month Jan 09 contract (ZRF9).

2008-12-01

TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: TRADE UPDATE: All that shines is not Gold

And once again (after the holiday related rally is out of the way) I am back again shorting gold. For a small time I was wondering (when I closed earlier short position - see previous update) that I might have to turn to Gold bull soon. But it seems from chart that the recent rally was nothing but a counter trend push during holiday season (that is why it is a good idea to be out of positions during the mad holiday period).

I have taken April Gold GCJ09 short at 784 area with stops above 853. I am planning to add up to 834 and looking for break of 743/699 and 688 for confirmation of trend. I am targeting 650 as first stop and possibly lower thereafter.

These trades are continuation of main theme in the first update so I am not repeating the arguments. Or simply follow the chain in the trade updates.

2008-11-28

TRADE UPDATE: COFFEE ROBUSTA 2008-09-23

My Development as a Commodities Trader: COFFEE ROBUSTA 2008-09-23

DF9 (LIFEE ROBUSTA COFFEE)

Sell 1980 - 2080 STOP 2200 Target 1580 - 1450 - 1050

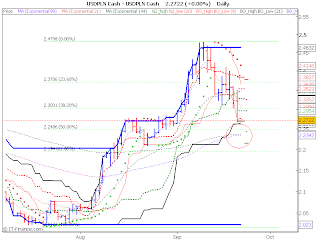

I am back in this trade today with a short initiated at 1980. I am looking to sell up to 2080 level. Break below 1580 will be first target. I am looking that this down leg could go well up to 1050 level in 2 - 3 months.

Coffee has climbed lately (fortunately since I came out of my earlier short) but now I feel that up move is completed. The futures have just touched 200 EMA and dropped from that point. In addition the general climate for coffee producers is not great. Producers have faced "credit crunch" and therefore rallies could meet with fresh selling.

Remember we are now trading Jan 2009 contract DF9.

2008-11-20

UPDATE: Looking for bottom in an abyss

My Development as a Commodities Trader: TRADE UPDATE: Looking for bottom in an abyss

This bottom (800 region) in S&P is now tested for the 5th time and with progressive lower lows. This makes it very weak and now I am not sure if it will hold in a meaningful way. Which means I need to analyse this and other markets in light of current situation. My option positions are with limited loss so I am leaving them on but most likely they will expire with loss and I am on sideline waiting for a clear direction. Tempting as it might sound, I am not keen on shorting this market as of now. And the weak bottom is not encouraging me to take long positions.

Technical and fundamentals are coming at loggerhead at current point. US markets have not seen 5 consecutive down months (even in 1920) so technically there can still be a rally but fundamentals are very weak.

Time to attend to the the garden and other matters while markets find a direction.

2008-11-13

TRADE UPDATE: Looking for bottom in an abyss

My Development as a Commodities Trader: TRADE UPDATE: Looking for bottom in an abyss

Even though the low point of S&P was breached today (816.75 previous 825) the rebound from the low further strengthens the case that a rally may be in the making. I was glad my position was taken via options so I there was no stop loss trigger (my losses are limited by the virtue of options) and I am happy that the market has changed direction after hitting the lows. Next few days will confirm if this rally has legs and then I can add aggressive positions.

TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: TRADE UPDATE: All that shines is not Gold

I am now (once again) out of this trade at 729 (about 42 points). Failure to breach 681 concerns me today. I am out of this trade now and need to watch if I end up becoming bull for gold in near future.

2008-11-12

Volatility and Range Bound Market

General Markets

The markets tend to be in two phases - trending and range bound. Trending markets are like thundering herd of bulls or fierce army of bears attacking fearlessly, pushing every thing in their path relentlessly, pausing only for a short breath from time to time. Range bound markets are like hand to hand flight between pigs and vultures with bulls and bear firmly entrenched, peeking their head out from time to time to fire a bullet here and there and then going back to their trenches. Neither side gives up their position and pigs and vultures end up losing money in the process. However any one with experience to combat fighting from the trenches (or with benefit of having read Joseph Heller's Catch 22) knows that life in trenches is not very exciting and finally something or someone has to give way and then the trend start again.

We seem to be stuck into those ranges lately and these seem to the treacherous times when one has to sit in filthy trenches and wait for trends to emerge. Any one brave (or mad) enough to venture out charging at the other side is likely to get torn to pieces. This explains the lack of updates from my end for sometime.

My view points are that October has set lows in the equities markets (and highs in the bond markets) and I am trading accordingly in that line but using more "options" instead of raw "futures". This can help limit my losses and also allows me to get ready for the breakout it arrives.

Some of the commodities are getting interesting as well. Cotton (CTH9) appears to have bottomed out and I would expect bounce soon but once again I lie in wait before a clear signal is on cards.

Cocoa (CH9 on liffe) and Coffee (DF9 on liffe) appear to be making short term high before coming down once again. I have traded them from the short side and I have been out of this trade as per previous updates. I remain on sideline to take next position. So the story can be that people in recession are more likely to clothe themselves instead of indulging into a hot mocha with choclate muffin.

Oil (CLZ8) appears to be following stock market tick for tick and the pricing is more demand driven now then supply driven. However, I feel that such low prices in Oil will sow the seeds for next bull markets as the lack of investment in alternatives and new production will land us in the same (or worse) situation when (and if) the world economy recovers again. So I lie in wait for a turn in Oil before becoming a bull again however current market is too volatile (and has some downside risk) before taking such positions.

As of now I remain short of Gold, Long USD and short TBond.

And I lie in wait in boring smelling filthy trenches.

2008-10-31

TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: All that shines is not Gold

I am back in this trade now that two uncertainties are out of the way. Fed has cut as expected and BOJ has cut as well. This should help bring some "stability" in the markets and cut those wild swings we have been witnessing lately.

Since long bonds (TBOND) anticipate future interest rate move, it is quite reasonable to expect that chances to interest rates rising in future for US are higher than lower. They anyway do not have a lot to reduce. There is of course talk of US rates going to zero or further down but I feel that would require a real armagadon to surface. As of now I am not hanging my hat on zero rates in US. Therefore I only see downside in long bonds. See Few bubbles left to burst.

With that said, I would expect Dollar to go up, Yen to decline (after an initial bounce up may be until 0.010600 area on IMM futures (JPYUSD) (94.34 in USDJPY term), bonds to fall and stocks to go up (possibly after testing some downside around 900-880 in S&P 500)

All this would leave gold on a precipatious path. The diwali demand from India is over and they did not buy as much jewelary as expected. Rupee decline has made Gold expensive in India even after recent fall in USD terms and the trend is likely to continue. My target for 650/550 remains and some projections are pointing to 450 level as well but that is bit far and I am merely keeping an eye at that level.

I have gone short at 771 level yesterday with stops above 840. At the first instance I am looking for breach of 681 where I will add to shorts and move stops down. I am looking to remain short gold until the inflation starts raising its head up and that would require the economies to improve.

What can de-rail this analysis is if US end up lowering rates further. Or stocks fail to stabilise and make new lows.

2008-10-24

UPDATE: Trade Ideas 22nd September

My Development as a Commodities Trader: Trade Ideas 22nd September

GBPJPY and AUDUSD trades worked liked a charm. Unfortunately for me I came out of them much too early with smallish profit but those who stuck to their guns must have gone walking to bank today.

TRADE UPDATE : TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: TRADE UPDATE: All that shines is not Gold

I am out of this trade today at around 690 region. I have not turned bullish on gold yet but something is in making and I will look at that carefully during weekend.

TRADE UPDATE: COFFEE ROBUSTA 2008-09-23

My Development as a Commodities Trader: COFFEE ROBUSTA 2008-09-23

Trade Update

I am out of this trade today between 1640 - 1585. Entry 2212-2137. About 562 points. Some downside still remains but I am on sideline as of now.

2008-10-16

TRADE UPDATE: Looking for bottom in an abyss

My Development as a Commodities Trader: Looking for bottom in an abyss

With recent price action, I feel we have found a short term bottom in the indices markets and we have reached a turning point. I am taking 865 and 837 as bottom for S&P and trading from the long side. I expect bounce up to 1150 - 1200 region (one of my projection is 1445 but I would not hang my hat on that one so early). Break below 865 will be warning sign and close below 837 will derail this analysis.

To limit risk I have taken certain option positions in line with this analysis. A good combo is to sell 3 x Dec 850 PUT, Buy 3x 800 Put and buy 1x 1050, 1150 and 1250 calls. Once the trade moves in the right direction, one can easily convert the calls into butterfly and close the puts. Futures position can be added on long side with stop below 865/837 area.

Price levels are based upon ESZ8 (December E-Mini S&P 500) future and not cash level.

2008-10-14

Feeling like a monkey .. anyone!

As heard from Diablo - a fellow trader (click for full discussion)

Once upon a time in a village, a man appeared and announced to the villagers that he would buy monkeys for $10 each. The villagers, seeing that there were many monkeys around, went out to the forest and started catching them. The man bought thousands at $10 and as supply started to diminish, the villagers stopped their efforts. So the man announced that he would now up the price and buy at $20. This renewed the efforts of the villagers and they started catching monkeys again.

Soon the supply diminished even further so the offer increased to $25 each and the supply of monkeys became so scarce that it was an effort to even see a monkey, let alone catch it! The man now announced that he would buy monkeys at $50! However, since he had to go to the city on some business, his assistant would now buy on his behalf.

In the man's absence, the assistant told the villagers. "Look at all these monkeys in the big cage that the man has collected. I will sell them to you at $35 and when the man returns from the city, you can sell them back to him for $50 each."

So villagers rounded up all their savings, and bought all the monkeys from the assistant. They then sat back and waited for the man to return from the city. However, they never saw the man, nor his assistant, ever again... only monkeys everywhere!

Welcome to the Stock market. ![]()

2008-10-12

TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: All that shines is not Gold

My first trade was stopped but I see the same trade valid again and I am going back in. Stops higher than 940 this time. Break below 830 to signal trend confirmation and place to add to shorts.

Few bubbles left to burst

TBOND (30 YR - ZBZ8)

TBOND (30 YR - ZBZ8)

Sell from 119'20 till 121'00 Stop above 123 Target 113'13 - 103'02

Last few days have seen a lot of bubbles burst. Just to recall so far I have seen the deflation of these bubbles:

a) Emerging Markets will drive the world economy on their own (the de-coupling theory) bubble - well in my view emerging markets are nothing but a leveraged play on developed world (read USA) economy. Their economies are still tiny compared to developed world economy and the trade between emerging markets is mainly intended for final consumer in developed world. China would buy steel from India to build factories to produce electronic toys using chips made in Taiwan or South Korea assembling flat screen TVs using Japanese technology and Chinese and Taiwanese parts is all good only when a trader earning millions in bonus is buying a new home to keep that new TV or Santa being exceptionally happy with a child whose Dad brought home a big bacon like every other year. Remove the consumer and the trade between emerging markets falls through. So when the developed world grows 1% you can bet emerging markets will grow 5% 10% even 20% and you can use these leverage to get more bang for your buck. But same applies when developed world does not grow and the leverage works the other way.

b) Stock market bubble which took S&P to its all time high similar time last year. What took 4 years to gain took just a year to lose.

c) Commodities are in "super cycle" and will continue to grow as world is running out of them. No longer true. We are not running out of wheat corn and soya nor are we running out of copper steel and aluminium. Even that illusive last barrel of oil looking to sell for $200 seems an illusion as of now. All we are running out of is speculators and retail investors building large positions in commodities pushing them much above their "marginal cost of production". Remove mania and you have "sensible" prices for commodities.

d) Dollar is going to be replaced as world reserve currency. No in fact this year Dollar is the best performing currency. One by one Dollar has turned corner against all currencies. Even GOLD has failed to make new high against dollar (though it took my stop!). The only currency which has performed well (and likely to continue to do so) against Dollar is JPY. In a troubled world, people still rush to Dollar. For Dollar to go down again we need the economy to start improving again. See earlier post (When going gets tough .... the Dollar gets going)

But there are still some bubbles left to burst. For example people are still buying Damien Hirst's "contemporary" art for millions and Candy and Candy are still banking on "super rich" clients buying their expensive apartments luxuriously designed. I am expecting these bubbles to burst soon as well.

In addition, I do not understand why US Government Bonds still remain in such demand when there is tremendous supply - given all these mega Bailout business going on in the developed world. Treasury is printing bonds for any and every purpose these days. So why should I be satisfied with a return of barely 4% over 30 years. One aspect which is keeping it going is the "security" of US Government. But some time people will either run out of money to keep buying these bonds OR they will start finding better things to do with their money (like keeping it in bank once trust returns OR start buying stocks when bottom is in sight). That would cause the bonds to tumble.

I am therefore looking to go short bonds on next up move which I expect to test 119-121 area. Break below 113 will give me clearer signal to add to these shorts and target new lows on ZB.

I am also looking to buy NASDAQ100 (NQZ8) around 1262 area if that can reach on Monday. This will however be a very small and quick in and out trade.

2008-10-10

TRADE UPDATE: Looking for bottom in an abyss

My Development as a Commodities Trader: Looking for bottom in an abyss

This trade has stopped out and I am on sideline. I am still looking for an upside but need to wait for the selling to stop.

2008-10-08

Looking for bottom in an abyss

S&P500 (ESZ8) and other world equity indices

S&P500 (ESZ8) and other world equity indices

Buy up to 960 stop below 940 target 1080 - 1180

I might regret writing this blog (and more so taking this trade) but I feel that we are reaching a bottom in S&P. I will analyse other markets for exact entry and exit levels but the analysis is likely to be similar. I am still not falling in love with upside but I do not see harm with a small fling for sometime. My target for this bear market (2007 - 2009) is 800 or lower and I still expect that to reach in 2009. However I feel that we now need a pause in this relentless selling we have witnessed for whole of last week. Can anyone imagine S&P was at 1250 just 2 weeks ago? So what factors ask me to see an upside here:

a) We seem to be in capitulation mode where people lose all sense of "reason" and trade with "just get me out of here mode".

b) VIX is hitting all time high. It cannot last or else option markets will go out of line with reality.

c) October Expiry is next week and I feel environment of fear is created (so that puts can be sold at inflated prices before they are allowed to expire worth less)

d) Central Banks world over have come together and even though I do not agree with lot of things they have resorted to doing, but at least there is no point picking up a head to head fight with fed. Ultimately markets will go where they are supposed to be going (which so far is 800 as my bear market target) but that does not mean they have to go there in a straight line.

I also feel some of recent selling was exagrated by some very powerful "fire sale". It was known that ice landic banks were selling assets to raise cash this week and I am sure there might be some more hidden skeletons somewhere in the world (which should start coming out soon). But I feel it should get over now.

This should give us a powerful relief rally, enough to suck a lots of recent undecided bears who will turn bull or get tagged while markets move up through their stops. Also election month in US should keep regulators on their toes to ensure markets do not become "sense less". However the next set of shoe to drop will be earning disappointments and further credit write downs (auto loans/credit card loans/commercial loans). That should give us the final leg of the bear market some time in Q1/Q2 2009.

So while I remain a bear, I would try to ride this move up. As always I will start by taking smaller positions as "probes" and once the trend is confirmed, I will be more aggressive and start buying on dips as well as moving stops up to limit risk.

The risk to this trade remain that it is quite "possible" that we may not stop at this point and sell all the way to 800 level. Afterall we did drop over 250 points in 2 weeks, so it is not surprising to drop further 200 points in next 2 weeks. So I will have one eye open for that eventuality. One "small risk" way is to buy butterflies for 1080/1160/1240 calls in S&P for December. That way the risk would be limited and rewards would be substantial.

2008-10-06

Commodities Are Tumbling

a) Panic - people are throwing towels left right and centre. This forces people to get out of bad investments and usually people first get out of good investments as no one wants to crystallise a loss. Though I never understood how a loss on paper is any better but anyway these situations create opportunities.

b) Dollar is getting stronger against rest of the world (except JPY).

c) Commodities are tumbling along with every thing else (except Bonds).

This is an important shift in the markets. Remember the heady days when the world was running out of rice and wheat and commodities exchange traded funds were talk of every social party. Well now those investments are being dumped by those who got on the train late. I am looking at the following trades in near future.

CORN (ZCZ8) - I am short corn and looking to sell up to 480 with stop above 520 with target 325 - 275.

SOY BEAN (ZSF9) - I am short and looking to sell up to 1020 with stop above 1100 and target 800 - 700

WHEAT (ZWZ8) - I am short and looking to sell up to 660 with stop above 750 and target 450 - 350

2008-10-01

All that shines is not Gold

GOLD (ZGZ8/GCZ8)

GOLD (ZGZ8/GCZ8)

Sell up to 900 Stop above 935 Target 650 - 550

This is a risky trade. Gold has recently made bold upward moves nearly $110 in just two days. The world appears to be running out of physical gold. The recent headlines are all bullish for Gold.

Investors start a fresh gold rush

Wealthy investors drain supplies of gold by hoarding bullion barsIt seems that the world is running out of Gold. Most GOLD ETFs have reported huge inflow of funds in recent days. So why do I look for downside in Gold. My reasons are all based on chart. It is quite evident that recent moves in Gold were driven by extreme panic. It is also a fact that extreme panic is usually short lived and it is best to fade (counter trade) the panic moves.

I have also been suggesting strong dollar (When going gets tough .... the Dollar gets going).

A careful analysis of the charts indicate that dollar has turned corner against all major (and minor) currencies and the bear market in dollar appears to be over. If dollar is strong usually that is not good for Gold.

Another source for Gold demand used to be jewellery demand from India. This is significantly low this year for obvious reasons. The price is too high and economy is no longer booming. Apparently India has imported 75% less physical gold this year.

Even in these panic moves, Gold has failed to make new highs or even hold on to current highs convincingly.

Factors which can go against this trade are - another round of panic or relentless hoarding of cash in Gold by rich investors who have lost faith in all world banks. Also LBMA (London Bullian Market Association) is forecasting a price of 980 by this time next year and they are usually quite accurate. But that does not exclude possibility that we can see a sharp move down and then return back to safety of Gold later when it is confirmed that the "bail out plan" does not solve the economic problems.

I have taken a small short in December Futures at 890 level. I am planning to add more after a breakout below 850. That could also be a time to start moving stops lower.

TRADE UPDATE: Trade Ideas 22nd September - II

My Development as a Commodities Trader: TRADE UPDATE: Trade Ideas 22nd September - II

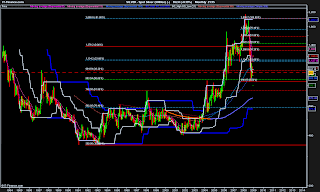

I have closed half my position at 2.3887 (1537 points) and moved stop loss to 2.2950 for the remaining half.

TRADE UPDATE: Trade Ideas 22nd September

My Development as a Commodities Trader: TRADE UPDATE: Trade Ideas 22nd September

I have closed my position at 0.7903 (546 points).

2008-09-28

When going gets tough .... the Dollar gets going

It was really cheeky of McCain to parachute himself into the negotiations just when all the "hard work" is about to be completed. It was a nice ploy to distract attention and may be score some points about his "country first" credentials. And at the same time I never understand why current US administration has to rule its subjects in such a climate of fear and bullying. Every major holiday period results into "red or orange" alert on all airports, promptly broadcast via all available loudspeakers and flat screen panels. And these days it appears all Bush speeches look similar. "Congress needs to pass this in shortest possible time or else we are doomed" seems to be the theme. First it was weapons of mass destructions and congress needs to commit US to war, then it was "stimulus" package to boost US economy and now it is committing $ 700 bln of tax payers money to bailout some wall street bankers. The only thing common is the siren call of impending doom and a "silly" smirk on the face of Mr. President as if telling the world - "don't think, we don't have time to think, you need to do this or else we are doomed". I am not sure why Americans allow them to be ruled in a manner that any voice of dissent is "unpatriotic" and any one who does not agree with the "Solution" is part of the "Problem".

Anyway, as clear from the rant above that we are in a very uncertain time. The problem facing the world markets is grave. After all merrier the party, messier the hangover (and of course the clean up afterwards under the influence of hangover with every T D and H shouting in your ear - I told you so).

I feel the bailout package will be passed in one form or the other. Most likely with "phased money instead of 700 bln upfront", "with lots of political/bi partisan/congress oversight of the process" and with some other "political agenda thrown in". Whether it will solve the problem or not will be a different question. My view is that it won't. It will avoid the melt down but it will not provide the boost. It can slow down the rate of decline but it will not start the growth. That will take its own time until the poison bleeds out of the system.

There is abundant talk that the bailout will crush the dollar however I do not feel it that way. Of course if the bail out helps start the "growth" once again in the world economy then possibly dollar will be under tremendous pressure. However given the scale of the problem, I do not see suddenly US consumers into buying frenzy once again, flocking to the Las Vegas condos with giant flat screen TVs from Korea and all those "Made in China" stuff. The decoupling theory that developing world can grow without depending upon the developed world is flawed and has been proven wrong already.

That leaves with the question - if Dollar is going down, what will go up?

- Would I rather hold Turkish Lira in these times or US Dollar. So that leaves emerging markets out.

- Commodities are already in bubble and that is bursting soon. We are not likely to see money returning to these sectors soon.

- Oil is under pressure and would remain so as long as world growth is under threat. Only upon turn around in growth would oil start making new highs once again.

So as long as there is no alternative to US Dollar as reserve currency, we will end up with stronger dollar while this mess is being cleaned up.

However I could feel only two assets which "might" be able to beat dollar. One is JPY - the huge unwinding of carry trades and rising inflation in Japan and alignment of growth between Japan and US might favour JPY. Second is GOLD - but only if the fear reins to high. These could provide interesting trade ideas for future.

2008-09-24

TRADE UPDATE: COFFEE ROBUSTA 2008-09-23

My Development as a Commodities Trader: COFFEE ROBUSTA 2008-09-23

I am now filled up between 2122 - 2137 for a small short with stops around 2360. I will be more aggressive seller once the breakdown begins below 2050.

2008-09-23

COFFEE ROBUSTA 2008-09-23

DX8 LIFFE (ROBCOFFEE)

DX8 LIFFE (ROBCOFFEE)

SELL 2100/2050/2000 STOP 2151 (adventurous) 2360 (safe). Target 1600 - 1400.

With commodities under pressure and dollar on the rise (yes it is, contrary to what every one might be calling - it would require a separate post on its own), coffee appears to be at an interesting point. It has been in a bull market late 2004 but the trend is looking tired. There is a big H&S on the weekly chart and it is also sitting on a long term trend line. Break below could take us all the way down to 1600-1400. I am planning to start with a small short position and add as the breakdown materializes below. At those points I can also bring down stops to reduce risk.

TRADE UPDATE: Trade Ideas 22nd September

My Development as a Commodities Trader: Trade Ideas 22nd September

I have taken small short in AUDUSD at 8450 with stop above 9300.

TRADE UPDATE: Trade Ideas 22nd September - II

My Development as a Commodities Trader: Trade Ideas 22nd September - II

I am filled in USDPLN long at 2.2350 with stop around 2.2000

I am reviewing other European Emerging Market CCY Pairs to take similar trade.

Short day trends on indices worked well so far and I am looking for a trend before committing larger capital.

2008-09-21

Trade Ideas 22nd September - II

BUY 2.2350 STOP 2.2000 TARGET 2.4600

In a deteriorating climate there is no way emerging market currencies can sustain their strength. USD has crossed 89 EMA to the upside and recent fall should give an opportunity to buy. Also up trend from these levels would signal start of wave 1-2 making the upside target way too high (to be calculated when markets show the up trend from 89 EMA bounce).

Other European Emerging Markets currencies have similar pattern it would be wise to keep an watch on them.

INDICES

Trade Ideas 22nd September

SELL 198/200/202 STOP above 215 TARGET 160/150/140 by March 2009.

It would be a bold prediction to say that I am looking at GBPJPY to trade at 161-142 by March 2009 but that is what I am looking at. GBP will be the worst currency to hold in 2008-2009 as UK has bigger issues compared to US and soon the world will start realising that. UK might end up as first currency to go in recessaion amongst G8. So I am looking to sell any rallies at 198/200/202 levels with stops above 215. Now considering this is a very wide stop, the size of the trade will be accordingly small and this is a very long term trade (nearly 8 months). Once confirmation is received that current rally is over (break below 187) I will become more aggressive in being a seller and moving stops down.

AUDUSD

AUDUSDSELL 84/86/88/90/92 STOP above 93 TARGET 62 by March 2009

The commodity bubble is busting and will start deflating sharply and AUD will be affected in a great way. The interest rates are on decline and will continue to be so. I am looking to sell rallies all the way up to 92 if we get there with stops above 93. This also makes this a high risk trade and therefore appropriate small sized "probes" will be required. Once the down trend is confirmed by break of 79, I will be more aggressive in selling and also will have move stops down.

Weekend after the regulators paniced

Extraordinary times required extraordinary measures! Certainly the times are extraordinary but is it governments business to intervene directly in the functioning markets. By preventing short selling of stocks the regulators might have been able to create a much required bear squeeze and they might end up punishing some hedge funds and short sellers. But will that solve the problem? Will RTC style vehicle solve the problems plaguing the financial markets? Well the answers will not be known for some time. Though it can provide some sort of floor to the markets (sellers will be reluctant to bet against fed and I am not sure there are many buyers out there after the short squeeze if finished). The upside is limited until I can clearly see recovery sign in economy. Markets lead economic indicators so any "possibility" of economy recovering might signal the end of the current bear markets BUT I think so far the bear market has not played out fully and at any sign of current bet by Fed and Treasury failing, the bottom will fall, buyers will drop the bids and we can see the fearsome bear again!

S&P ESZ8

The 2 day up move can be a change of direction OR a time to sell once again. I am looking for sign of weakness to initiate short positions but will be a nimble scalper on the buy side if the squeeze continues. Don't fall in love with the upside is still the motto!

WTI CLX8

Oil has rebounded sharply after hitting lows. The upside seems temporary though. I am looking to sell 105 - 107 area with stops above 110 and looking for further downside in the 80 - 90 region.