My Development as a Commodities Trader: TRADE UPDATE: COFFEE ROBUSTA 2008-09-23

2008-12-31

TRADE UPDATE: COFFEE ROBUSTA 2008-09-23

2008-12-16

UPDATE: When going gets tough .... the Dollar gets going

My Development as a Commodities Trader: When going gets tough .... the Dollar gets going

TRADE UPDATE: Is silver setting up to outpace Gold?

My Development as a Commodities Trader: Is silver setting up to outpace Gold?

2008-12-07

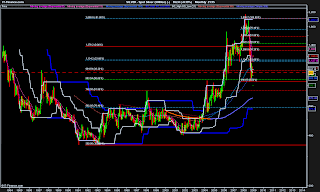

Is silver setting up to outpace Gold?

SILVER SIH9/ZIH9 GOLD GCJ9/ZGJ9 PAIR

SILVER SIH9/ZIH9 GOLD GCJ9/ZGJ9 PAIR

2008-12-06

TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: TRADE UPDATE: All that shines is not Gold

I am out of this trade again at 760 (+24 points) though I was hoping to ride is much longer. The range action is frustrating me in most markets and I thank all my guardian angles whenever I can come out profitably on any trade in these markets. I am by nature a trend following trader and therefore the range kills me many times.

The price action on S&P during Friday session rang some alarm bells for me and I was in no mood to leave positions over weekend. In addition Gold did touch my first anticipated breach level (743) but bounced off strongly.

If I see weakness next week I might go in again as I am still not a bull of Gold but for the time being, remaining out of this market seems like a reasonable position to be in.

Rice is Rising

ZRH9 (Rough Rice)

ZRH9 (Rough Rice)

Buy on break above 1426 stop below 1330 target 1559 - 1669

While reviewing grains chart it caught my eye that when all other grains (wheat/soy bean/corn/oats) are making new lows and plunging further, rice seems to be the one which has bounced off smartly and also resisting any down days in other grain complex. Rice has bounced off a long term support and therefore some upside could be possible. I am watching if Rice breaks above 1426 or if 1330 level is not breached before entering the trade.

Since fundamentals come in charts first I will also keep an eye on any fundamentals developing.

Point to note is that rice is bit illiquid on CME and therefore can easily be manipulated so it pays to be on the right side of the manipulators. For the same reason I would look to trade March 09 contract (ZRH9) and not the front month Jan 09 contract (ZRF9).

2008-12-01

TRADE UPDATE: All that shines is not Gold

My Development as a Commodities Trader: TRADE UPDATE: All that shines is not Gold

And once again (after the holiday related rally is out of the way) I am back again shorting gold. For a small time I was wondering (when I closed earlier short position - see previous update) that I might have to turn to Gold bull soon. But it seems from chart that the recent rally was nothing but a counter trend push during holiday season (that is why it is a good idea to be out of positions during the mad holiday period).

I have taken April Gold GCJ09 short at 784 area with stops above 853. I am planning to add up to 834 and looking for break of 743/699 and 688 for confirmation of trend. I am targeting 650 as first stop and possibly lower thereafter.

These trades are continuation of main theme in the first update so I am not repeating the arguments. Or simply follow the chain in the trade updates.