key levels – indices, Grains, OIL, Currencies, Bonds, Metals

WARNING – I could be spectacularly wrong here. Do not follow blindly and jump out on signs of trend reversing.

It has been an exciting summer for many and as far as markets go, it was quite a choppy session. However a clear pattern is visible in all developed world markets (and much earlier in the Developing World – India/China/Brazil etc) and that of an abundant return of confidence. Markets have rallied without a significant pullback since March 2009. It is bit tough to find a fundamental reason for such strong recovery when the underlying economy is still on crutches but who said markets are rational.

Autumn and Winter 2009 could be a great period for current trend as the Markets are now setting up into a vacuum zone as Oscar calls it.

Starting with a bullish stance in June 2009, I flattened my positions and took a bearish stance for rest of the summer expecting a correction which so far did not materialise to the extent I was expecting. Recent price action leaves me flat on my positions once again looking for next set of trends to build on.

A NOTE OF CAUTION – it could very well be a summer low volume play and the markets could very well reverse drastically on down side and the whole bull market hoopla turns out to be an pouncing opportunity for bears who return after summer vacation. After all the world has not changed much and there are still several reasons to start selling. Caution is required going into early part of September. Also I do not see this as start of a secular bull market, instead I see it as last legs of the current trends. Possibly we will have new chapter/direction later on the in the year.

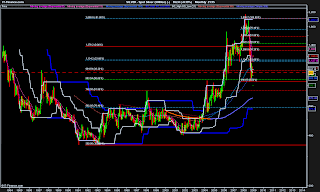

S&P500 (ESu9/z9)

The case for bulls is quite strong and I feel we are in the final leg of the up move from March before a long term correction/pullback sets in. My key projection level on upside range from 1066 – 1229. A very wide zone I agree but some are key milestone targets where I will be tempted to watch the action (or move stops higher).

Current Position – Small Long (1025 area)

Bias – Build Long position on breakouts and pullbacks. 972 key level to watch on downside with stops below that level.

Nasdaq 100 (NQu9/z9)

Nasdaq has been much stronger compared to S&P500 and if the bull market is continuing, it should likely to benefit more on the upside. But given the same reason, Nasdaq had been butting against the key sell level (1633) for a long time and it should remain above this level for me to comfortable about the longevity of the bull market. So NQ will be my key barometer on this breakout market. My projections are 1633 – 2040 range (again very wide) but I have some intermediate levels to keep an eye on.

Current Position – Small Long (1635 area)

Bias – Build long position on breakouts and pullbacks. 1560 is key level to watch on downside with stop below that level.

Nikkei 225 (Japan)

The benchmark index of Japan has seen the mother of bear market and has seen decades of decline. In some sense Japan has witnessed the effects of a bubble burst and deflation, things which western world is panicking about today and also most central bankers are trying to avoid. There are however signs that finally after decades of savings, Japanese consumers are waking up to spending. Any global turn around should help.

My current projections on Nik225 are 12000-12384-13000. Break below 9600 will negate this analysis. I do not have any trades on.

CORN (ZCz9)

On my EW analysis, the current bear markets in Corns appears to be over and 300 level in Corn should act as good floor to build positions on. Fundamentally, there is abundance of Corn crop but I feel that is already priced in the markets. Inflation fears and rising crude oil should support Corn at these levels and possible shoot it higher. However end of bear market does not always mean start of next bull market and very often Elliot Waves are not accurate in exact levels (they are good for direction though). In terms of my trading plan, I am starting with key level long dated call options (360/470). Failure of a key short level at 344 could help me come into the trade properly.

Current Position – Flat

Bias – Start with longer dated options on key levels. Look for a short setup failure before getting long with stops below 310.

Wheat (ZWz9)

Wheat on the other hand does not confirm that the down move is over, though it is at support level here. Some of my silly (it seems now) see wheat all the way down to 317 level. I am not prepared to back such a bold bet as of now but instead I would look to sell breaks below current lows. Can act as a good hedge against the corn options.

Current Position – Flat

Bias – Small Sell breaks below lows (485) or watch for action along with Corn/Soybean

Soybean (ZSx9)

The most volatile and exciting of the grains complex is also the most fickle. Best used as a leading indicator for other markets or short term trades. So far I do not see any long term trends. 1180 are likely near term targets if the bullishness continues but none worth putting a fat trade on. Best to be traded on day by day basis.

Crude Oil (CLv9/z9)

Like other commodities complex, crude oil has also shown the return to bullish momentum since bottoming out at $35. From the EW perspective, the Crude should be heading to 88 – 95 region. The pattern with negate on the breach of $58 level on the downside. However given that crude is now trading at 74, the risk rewards are 1:1 on such trades and not worth putting a big position. Need to wait for next big wave. I will continue to trade on day by day basis if opportunities arise keeping the broader direction in mind. The whole energy complex except Natural Gas (NG) is setting up for this bullish formation and worth keeping an eye.

Dollar Index (DXu9/z9)

US Dollar appears to be heading for completing its last wave of down move which can take it all the way down to 72 – 75 region. Considering we are around 78-79, there is not much risk:reward in left in long term trade so worth playing on the downside on short term basis. If DX moves up to 82 I will need to think of a different scenario but until then I am not a dollar bull. Mostly on sidelines watching the fun.

Along with Dollar, I feel GBP is another currency to sell in coming days and month. It seems to have topped and has a long way to go down.

T-Bonds (ZBu9/z9)

Bonds are one market which is sticking out like a sore thumb. If the world trouble are getting over, the interest rates should start heading up, especially the long term interest rates. And for a long time, I am of the view (which had been quite profitable) that the long term bull market in govt bonds is OVER. But current setup points that most bonds (T-Bonds, German Bunds and even UK Gilts) are looking up. The central banks are keeping the market distorted. Banks are also buying bonds instead of putting the money in economy to repair the damaged balance sheets and keep cushion. Or they are simply setting up for a juicy short somewhere up there. In all cases, I am on sideline watching them wearily. Hopefully some clue will emerge soon.

Gold (GCz9)/Silver (SIz9)

Gold and Silver markets have been consolidating in a range for better part of this year. Best is to play them on range breakout basis. For Gold, I am watching 966/900 level. Breakout above could lead it to 1220/1350 level. Breakout below could target 840-740 area.

Silver is in similar predicament and similar levels to watch for breakout are 15.40/12.40

Cocoa (Cz9 on liffe)

Cocoa is setting up for upside breakout once again. Buying dips and breakouts with stops below 1700 is the plan currently.