SILVER SIH9/ZIH9 GOLD GCJ9/ZGJ9 PAIR

SILVER SIH9/ZIH9 GOLD GCJ9/ZGJ9 PAIR

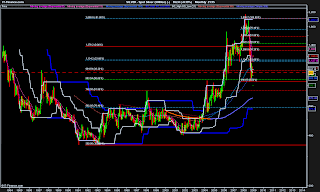

Buy 16 Silver and Sell 10 Gold futures.

Stop when GOLD/SILVER > 100

We saw spectecular run up in the the prices of Gold and Silver last year with Gold culminating into an all time high and silver in a significant high before both of these "precious" metals started falling like a stone so far this year.

Silver in particular has fallen by nearly 60% from its high whereas Gold has managed about 34%. This is quite expected as Silver tends to be more volatile of the pair and tends to shoot excessively in both directions (up or down).

Now I made an interesting observation that the last bull market in Silver started in March 1993, nearly 6 years before Aug 1999 when Gold bottomed out. So even though I am oscillating between Bear or Uncertain camp for Gold it "could" be that Silver has seen its correction and may be it is turning its head upwards.

In addition the Gold/Silver ratio is hovering at 80 after hitting nearly 92.5 in October 2008. Such high readings were noted in 1993 when silver started turning up as I pointed out earlier. The reasonable level for this ratio is 50 and the historical mean level for this ratio is actually 16. This points that silver now is extrement cheap compared to Gold.

An adventerous trade is actually to buy Silver with stop below 8.40 however in the current climate of volatility it could be safer to trade this as a pair and then cover Gold Short when inflation start raising its head again.

No comments:

Post a Comment

Thank you for your comments. Please keep the comments to the context of the discussion. Comments are subject to moderation and inappropriate comments may be removed by the Author of this blog.

-VS